How to Budget & Track Your Spending + FREEBIE

Write | Inspire | Dream

Budget & Track

Budget & Track your savings advice from a millennial? Interesting, I know, so trust me, this blog isn’t coming to you from a self-professed expert. I decided I wanted to write this blog for two reasons. One. To share my experiences with finances and spending and the lessons I personally have learned. And Two. So I could share with you the fabulous Budget Tracking Guide I created when I developed my 30-Day Intentional Living Challenge. This blog is here, like all others, simply as a resource and tool to reference for bad habits to kick for spending, money-saving tips, or how to create a financial plan. Just like with many of the topics that graze into Intentional Living, like my Mental Health blog, I’m writing it because it’s important and a part of living an Intentional Life.

The I Needs V. The I Wants

The most important financial lesson I learned in college, living an expensive city, is the difference between need and want. It’s a valuable lesson that I’m still gaining knowledge in today. Now I don’t just mean when you’re at a store, and you see something, is it a question of, “Do I need this or want this?” I’m also talking about you need to pay your bills like rent, but you want to eat out with your friends a lot. (Lol, me!) Let me tell you, being in college, in New York City, at that age, with some of the most amazing restaurants, bars, and clubs at your disposal, “saving” wasn’t a top priority. Now, is obviously a different story, not living in NYC, Covid, and other things. But I’d also like to think I’m growing up and learning my life lessons.

I think what got me so stuck in spending money, was the idea of missing out on an experience. When your friends invite you out for dinner, or brunch, or to the bars… The word ‘No’ just kind of slips from your vocabulary. But I didn’t need to do that. What’s so bad about changing a girl’s night out to staying in and cooking together and watching movies? But like I said, these are lessons we learn as we grow. I know not everyone even has the option to make these choices because their budgets are already set and much tighter, so they have developed these habits early and learned quickly how to successfully manage their money. This is fantastic, we all learn and develop these habits at different points in our lives.

5 Financial Habits of Successful Women

1. Set Financial Goals.– Start small by setting one or two goals, like not buying coffee out or not eating out. Then move up to bigger financial goals like put ‘x’ amount of dollars into your savings each month, investing, etc. Eventually, through incremental goals, you can grow your money-saving abilities. You can also use the La.Rue Goal Setting Guide to implement your Financial Goals and break them down!

2. Set Budgets for Variable Expenses – Like in other blogs, I’ve preached about accountability when talking about goals. By setting budgets, keeping them in mind, and sticking to them, you’ll hold yourself accountable to not just your spending but your saving. On the Budget Tracking Guide, you’ll find an entire section for your variable expenses that will help you identify your goals.

3. Have Multiple Revenue Streams.– Ladies, we are growing up in a generation where investment portfolios are second nature to income, and knowledge of stocks is valuable. Start small by learning to invest small sums of money into publicly traded companies you feel your investment would find value in. It’s great to have a stock portfolio that also backs as a second savings, so grow your knowledge and begin investing.

4. Have Savings.– For as long as I can remember, my mom has instilled in me that you should have savings to cover you for six months should something happen to your income—six months’ worth of bills and livable income to cover expenses like groceries, gas, etc. Your savings is your life jacket on a cruise ship. You don’t ever think it will sink, but we’ve all seen Titanic. Now, for us younger people, of course this will take a lot of time to build. But just keep it in the back of your mind when you’re deciding what to do with even the smallest extra bit of your paycheck.

5. Control your Money – Don’t let your finances or money be a negative light in your life. Make sure your earning, spending, and saving what you should be. Did you know that most companies feel you’re entitled to a promotion every three years and a raise potentially as often as every year at the beginning of your career? Make sure you’re asking for a raise when you’re entitled to one. Do research on what other companies are paying people in your position to make sure you’re making what you should be, even at entry-level positions.

Budget Tracking Guide

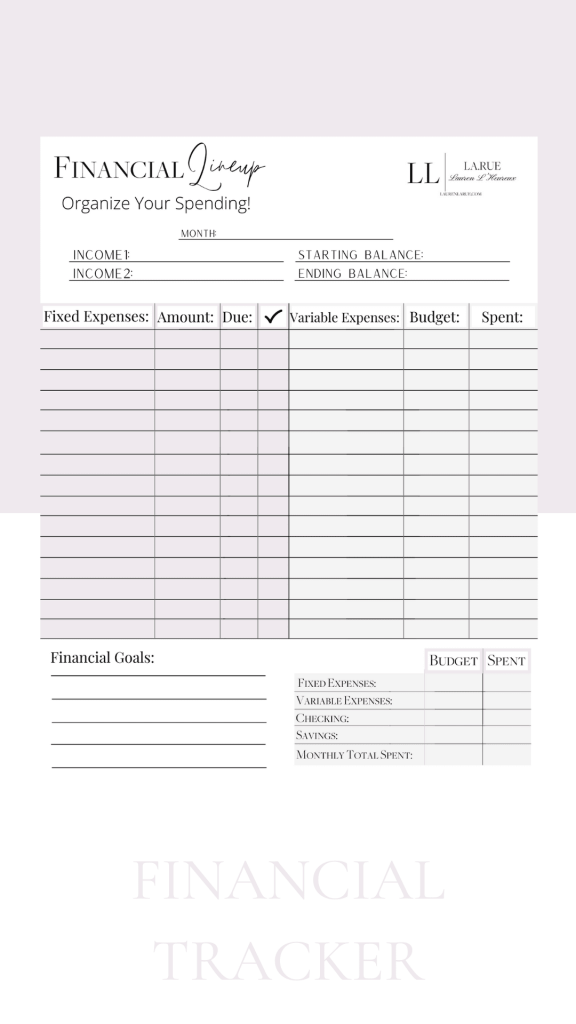

The La.Rue March FREEBIE is HERE! The Financial LineUp or Budget Tracking Printable is your resource from La.Rue to track your spending Intentionally! So, let’s break down the guide. First, you’ll notice that this is a monthly guide. What’s great about tracking your spending monthly is that you’re looking at the numbers more often, meaning you’re more aware of your reality. What are your goals, what should you be spending, saving, etcetera? Next, you’ll fill in your first income for the month; most people receive two paychecks per month. Then you’ll fill in your starting balance. You’ll take the starting balance of your checking account(s) and put the number there. This will show you what you’re averaging based on income and spending at the beginning and end of each month.

Fixed Expenses V. Variable Expenses

Then, we reach your expenses. Your fixed expenses are bills, things like rent, car insurance, phone, etc. These are things that have the same balance every month with a due date. I like to separate mine by manual payment and automatic withdraw. So if you have some that automatically come out of your account, out those at the top with their amount and due date and check them off as they come out. Then you have your manual payment. A great app I recommend is TRUE BILL. Truebill helps you track your expenses and sets reminders on your phone of an upcoming payment. This is great for those manual payments.

Next, you’ve got your variable expenses. Here you have expenses where the amount varies like groceries, gas, eating out, etc. What I HIGHLY recommend doing is printing out 3 months worth of bank statements to see what you spend on average each month on these categories and any others you have. Then, decide if that average is too high, too low, or just right. Once you’ve got a number you like for that category, you’ve got your budget. See where you need to cut back (like eating out) and where you could reallocate that money (like groceries to eat in) and come up with your monthly budget.

Lastly, you’ve got the section on the bottom. Any financial goals you’d like to set for yourself, write them here. Simply putting them on paper and seeing them as you fill out your Budget Tracker throughout the month will help remind you of your goals. Then you’ve got the Budget V. Spent box. At the beginning of the month, you’ll have the budget side filled out. Add your fixed and variable expenses and put them in their boxes. Then any additional spending money you think you’ll use to go over budget, like a spontaneous night out with friends, that’s your checking. Savings is any emergency budget you may need. And finally, you add all the numbers together and give yourself a total.

Budget & Track Your Spending

Each month, you’ll learn from your spending and saving habits and develop a better relationship with finances. By writing down your goals and seeing the numbers on paper, you’ll be more exposed to your reality and your spending versus a bank statement you never look at. When you’re aware of your spending, you’re aware of your savings. When you’re aware of what you’re saving and investing, you become a more responsible person, with the ability to do the things you want because you have strong financial independence. So, print out your FREE Budget Tracking Guide by going to the FREEBIES page in the shop and get to work building your budget!